The IRS Is Not ALWAYS the Bad Guy!

Although the Internal Revenue Service is often a favorite bad guy, and this blog frequently casts aspersions and sideways glances at many IRS policies and practices, this time The Service is practicing at being the hero. At least a little bit heroic, anyway.

Although the Internal Revenue Service is often a favorite bad guy, and this blog frequently casts aspersions and sideways glances at many IRS policies and practices, this time The Service is practicing at being the hero. At least a little bit heroic, anyway.

IRS announced on June 9 an increase in the optional standard mileage rate for the 2nd half of 2022 !

In recognition of recent gasoline price increases, the IRS made this special adjustment for the final months of 2022 (that’s July – December, just to be clear).

So What Does This Really Mean to Taxpayers?

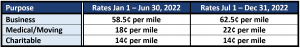

Every year on their tax returns, taxpayers can opt to use the optional standard mileage rates to calculate deductible costs of operating an automobile for business (and for certain other special purposes). What the government is offering here for the final 6 months of 2022, the standard mileage rate for business travel will be 62.5¢ per mile — an increase of 4¢ from the rate effective for January–June.

But wait! There’s more!

The new rate for deductible medical or moving expenses will be 22¢ (available for active-duty members of the military) for the remainder of 2022, also up 4¢ from the rate effective at the start of 2022. These new enhanced rates become effective July 1, 2022. The IRS provided legal guidance on the new rates in Announcement 2022-13, if you are very keen to double-check the fine print.

All of our readers know that the funny little ¢ symbol stands for cents, right?

But What Does This Really, Really Mean?

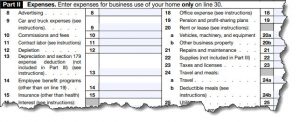

The IRS normally updates the mileage rates once a year in the fall for the next entire calendar year. And then when we file our taxes (or when a qualified accounting firm like Baum CPA carefully files taxes for careful clients), the IRS-approved optional standard mileage rates are plugged in for the documented and auditable number of miles driven in each respective allowable category — and the allowable dollar deduction is calculated.

This year, for miles driven from January 1 through June 30, 2022, taxpayers should use the rates set forth in Notice 2022-03 (58.5¢ per mile and 18¢ per mile, respective of the allowable category, as shown in bold text in the prior section, above). The special gas-price-relief enhanced bonus rates (shown above as 62.5¢ per mile and 22¢ per mile, respectively) apply to miles driven from July 1 through December 31, 2022.

Which will translate to a teensy additional tax preparation effort of calculating the allowable optional standard mileage dollar deduction amount in two parts. And bear in mind, of course, that tax returns get prepared at the beginning of the following year for the previous year, so none of this math applies until early 2023!

File your taxes on time by April 17, 2023 (because April 15th falls on a weekend again!), and you can expect your optional standard mileage deduction gas-price-relief enhanced bonus to serve as a kind of rebate against allowable business, medical, and moving travel expenses that happen the rest of this year, 2022.

The Poop from On High

IRS Commissioner Chuck Rettig has stated, “The IRS is adjusting the standard mileage rates to better reflect the recent increase in fuel prices … unusual factors have come into play involving fuel costs, and we are taking this special step to help taxpayers, businesses and others who use this rate.”

The IRS also advises that items other than just gas prices enter into the calculation of mileage rates, such as depreciation and insurance and other fixed and variable costs. Further, the optional business standard mileage rate is used to compute the deductible costs of operating an automobile for business use instead of tracking actual costs, and the rate is also used by the federal government and many businesses to calculate reimbursements to employees for mileage. So, if you are fortunate to receive cash reimbursement from an employer for mileage at the new higher rates, then you won’t have to wait until you file your taxes to realize the benefits of this gas-price relief!

Taxpayers always have the option of calculating the actual costs of using their vehicle instead of using standard mileage rates.

And, oh by the way, the 14¢ per mile rate for charitable organizations remains unchanged for the entire year as it is set by statute.

A mid-year increase in the optional mileage rate hasn’t happened since 2011.

Here’s the recap on this year’s 2022 Mileage Rate Changes:

Source of this Stunning IRS News Brief

https://www.irs.gov/newsroom/irs-increases-mileage-rate-for-remainder-of-2022

Where to Go for Advice and Help with All Things Tax-Related

If you would rather avoid grappling with any of the mechanics behind IRS tax filings, and prefer to just leave the deduction calculations to a trusted accountant so you can just confidently skip ahead to signing the completed returns, then you have come to the right place. At Baum CPA, we provide the expertise to expertly support business owners every step of the way. Just click here to schedule a consultation appointment today!

This blog and its authors provide this content strictly for informational purposes. No content herein should be misconstrued as financial advice. Everyone’s specific circumstances vary — Always consult with a qualified, licensed financial advisor, legal counsel, and tax professional before venturing into any investment or business activities.