Does any of this apply to you?

- You run a business in your home.

- You run a business from your home.

- You run a home-based side gig.

- You are self-employed and conduct some aspects of your business from home.

If you answer yes to any of the above, then you should be capturing the costs of your home office, and deducting them from your taxes. The rules are not always simple, however, and you need to keep careful records.

If you answer yes to any of the above, then you should be capturing the costs of your home office, and deducting them from your taxes. The rules are not always simple, however, and you need to keep careful records.

What the IRS Says about Home Office Deductions

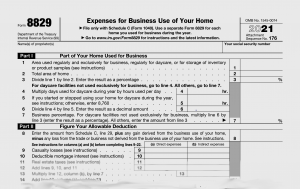

The IRS will tell you (in 6 concentrated pages of instructions) that you can use Form 8829 to figure the allowable expenses for business use of your home to enter onto Schedule C, which comes with an additional 20 pages of instructions and in turn gets attached to your Form 1040. To deduct expenses for business use of your home, you must meet specific requirements, many of which are limited or legally restricted.

In view of these limitations and legal restrictions, IRS will also refer you to Publication 587 for 35 additional pages of greater detail and clarity on topics such as modified accelerated cost recovery system (MACRS) to calculate allowable rates of depreciation for assets associated with your home business expenses — in case asset depreciation applies to your home business expenses, that is.

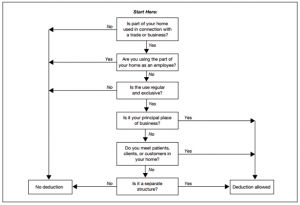

Here’s perhaps the most useful diagram Uncle Sam offers (from Publication 587) to help you as a taxpayer decide whether you can even deduct business use of your home expenses. (But, do not rely on this chart if you use your home for the storage of inventory or product samples, or to operate a daycare facility — those functions have their own sets of rules!):

Chart from IRS Publication — Can You Deduct Business Use of the Home Expenses?

Chart from IRS Publication — Can You Deduct Business Use of the Home Expenses?

In several places, IRS also mentions using the “Simplified Method,” which is “an alternative to the calculation, allocation, and substantiation of actual expenses.” In most cases, the taxpayer can figure their deduction by multiplying the area of home used for qualified business use by $5.00 (the government prescribed rate). Oh, and that area is limited to 300 square feet, by the way — a little more than the size of a single-car garage. If you use the simplified method, you are not allowed to deduct any actual expenses that are related to use of the home for the business (so cell phone and auto mileage and inventory are still deductible).

Is your business-oriented brain swirling in the IRS complexity of tax rules, despite their terminology of “simplified method?” Do all these tax complexities distract you from your central purpose of actually running your small business effectively and efficiently — and most of all, profitably? Maybe you would like to schedule a discussion with the small-business tax experts at Baum CPA. Our first consultation is simply one click away: So, make an appointment today. We can answer your questions and file your returns correctly according to so many complex rules, to save you from the labyrinth of IRS forms and instructions.

Genuinely Simplified Rules for Home Office Deductions

IRS tells us that if a part of your home is used exclusively and on a regular basis for business purposes, you are allowed to deduct business expenses that apply:

- As your principal place of business for any of your trades or businesses;

- As a place of business where patients, clients, or customers meet or deal with you in the normal course of your trade or business; or

- In connection with your trade or business in a separate structure not attached to your home.

There are exceptions to the exclusivity requirement if space is used on a regular basis for:

- Storage of inventory or product samples (you can stockpile your Etsy products in the garage, and still park your car in there, too)

- Certain daycare facilities (the kiddies in your care are allowed to use the same powder room as your party guests — just not at the same time!)

Principal Place of Business

To determine if your home office qualifies as your principal place of business, you must consider two issues.

- The relative importance of activities performed at all places where you do business.

- The amount of time spent at every place you do business.

Your home office will qualify as your principal place of business if you meet these requirements:

- You use it exclusively and regularly for administrative or management activities of your trade or business.

- You have no other fixed location where you conduct substantial administrative or management activities of your trade or business.

Here is the official government shopping list of what qualifies as administrative or management activities. (Actually, the IRS offers only these few examples; there are conceivably LOTS more that ALSO qualify!).

- Billing customers, clients, or patients.

- Keeping books and records.

- Ordering supplies.

- Setting up appointments.

- Forwarding orders or writing reports.

The following administrative or management activities performed at other locations by you or others engaged in your business will NOT disqualify your home office from being the principal place of business.

- If you have others conduct your administrative or management activities at locations other than your home, such as if you outsource your billing… or your tax accounting services!

- If you conduct administrative or management activities at places that are not fixed locations of your business, such as in a car or a hotel room

- If you sometimes conduct minimal administrative or management activities at a fixed location outside your home

- If you conduct a lot of non-administrative or non-management business activities at a fixed location away from home, such as when you meet with or provide services to customers, clients, or patients at another location

- If you choose to use your home office for administrative or management activities, even though you have suitable space to do these things elsewhere

Other Allowable Tax Deductions Related to Home Offices

Assuming you meet all of the above and are ready to deduct the physical space of your home office, have you also considered allowable business deductions related to that space? Expenses such as:

- A reasonable business percentage of your phone use?

- A matching percentage (based on allowable home office square feet) of property tax expense, mortgage interest, repairs and maintenance expenses (unless you pay rent instead, of course)?

- A matching percentage (based on square feet) of utilities and internet expenses, homeowner’s or tenant’s insurance, and security system expense?

All of the above pretty much covers all the basics about home office tax deductions, in the simplest terms we can provide.

If you have read all of this advice and are ready to tackle filling out the IRS Form 8829 and Schedule C on your own, AND you feel confident to read and understand their Publication 587 for 35 pages of government clarifications, then our hats are off to you! We earnestly wish you the best.

If you would rather opt for a consultation with Baum CPA, to find out how our many decades of combined small business, WFH, tax preparation, and personal experience with the IRS can help you declare ALL of your allowable business deductions AND stay out of trouble with the IRS — then simply click here.

This blog and its authors provide this content strictly for informational purposes. No content herein should be misconstrued as financial advice. Everyone’s specific circumstances vary — Always consult with a qualified, licensed financial advisor, legal counsel, and tax professional before venturing into any investment or business activities.